MOBILE BOOKKEEPING APPS: SIMPLIFYING FINANCIAL MANAGEMENT FOR SMALL BUSINESSES

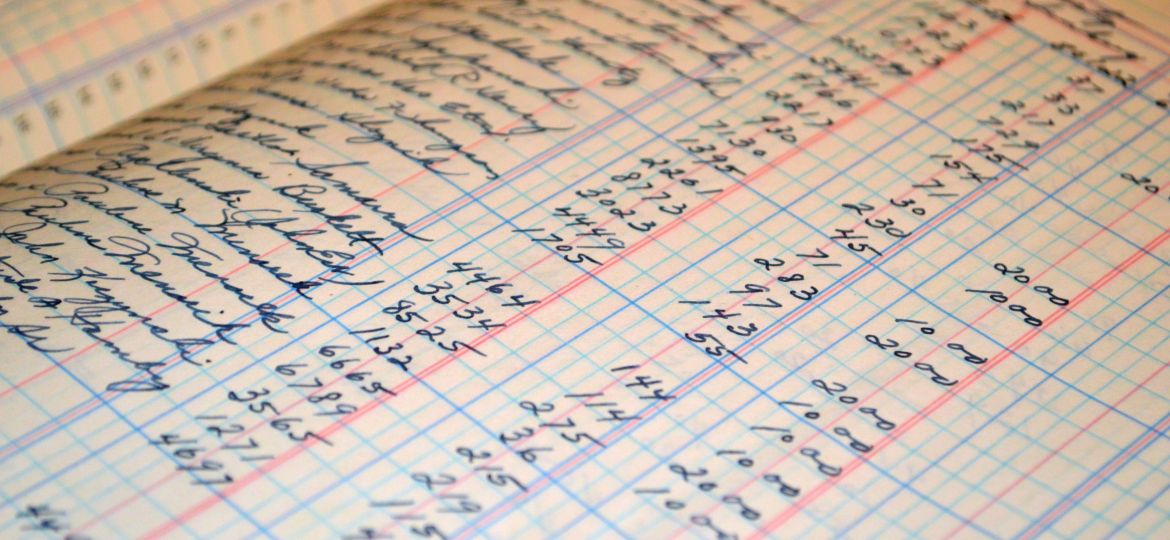

In today's fast-paced business world, time is indeed money. Small business owners are constantly on the go, juggling multiple tasks, attending meetings, and managing employees. Amidst all this chaos, bookkeeping and financial management can often take a backseat. However, with the emergence of mobile bookkeeping apps, managing finances has become simpler, efficient, and hassle-free. In this blog, we will explore how mobile bookkeeping apps are revolutionizing financial management for small businesses, how they work, and the benefits they offer.

- Introduction: Why Mobile Bookkeeping Apps are Essential for Small Businesses

- Top Features and Benefits of Mobile Bookkeeping Apps for Simplified Financial Management

- Top Mobile Bookkeeping Apps to Help Small Businesses Manage their Finances

- How Mobile Bookkeeping Apps Can Save Time and Money for Small Business Owners

- Conclusion: The Future of Bookkeeping for Small Businesses is Mobile

Introduction: Why Mobile Bookkeeping Apps are Essential for Small Businesses

In today's digital age, mobile bookkeeping apps have become an essential tool for small businesses who want to stay on top of their finances. With so much competition in the market, companies need to be able to manage their money effectively, and mobile apps are a convenient solution. These apps allow business owners to make transactions, track expenses, and access financial reports all from their mobile devices. This means that even when they are on-the-go, small business owners can stay up-to-date with their financial situation. Mobile bookkeeping apps are not only convenient but also affordable, making them accessible for businesses of all types and sizes. With the help of these apps, small businesses can streamline their financial management, save time, and stay ahead of their competition.

Top Features and Benefits of Mobile Bookkeeping Apps for Simplified Financial Management

Mobile bookkeeping apps are becoming increasingly popular in small businesses due to their features and benefits. These apps allow business owners to manage transactions easily and efficiently by tracking expenses, invoicing clients, and monitoring financial reports all in one place. One of the top features of mobile bookkeeping apps is its cloud technology, which allows for secure data storage and accessibility from any device with internet connection. Additionally, automation of data entry and categorization saves time and reduces the likelihood of human errors. Mobile bookkeeping apps also provide benefits such as improved cash flow management, better insights into business performance, and simpler tax preparation. These apps are geared towards simplifying financial management for small business owners, thus freeing up their time to focus on growing their business.

Top Mobile Bookkeeping Apps to Help Small Businesses Manage their Finances

With the technology advances in recent years, mobile bookkeeping apps have made it easier for small businesses to manage their finances on the go. These apps have become increasingly popular amongst small businesses as they are designed to simplify financial management, eliminating the need for complicated spreadsheets or paper-based systems. Some of the top mobile bookkeeping apps that small businesses can use to manage their finances include QuickBooks, Xero, FreshBooks, Wave, and Zoho Books. These apps provide a range of features such as automated invoicing, expense tracking, and financial reporting, helping small businesses stay organized and manage their finances more efficiently. With the ease of use and cost-effectiveness, it's no wonder that mobile bookkeeping apps have become a go-to solution for small businesses looking to streamline their financial management.

How Mobile Bookkeeping Apps Can Save Time and Money for Small Business Owners

Mobile bookkeeping apps have numerous advantages for small business owners who want to manage their finances effectively. One of the most significant benefits is time-saving. With bookkeeping apps, small business owners can easily manage and monitor their financial records on the go. The apps also allow for real-time updates, making it easier to track income, expenses, and cash flow. Mobile bookkeeping apps can also help businesses save money by eliminating the need for expensive accounting software or hiring a full-time accountant. Business owners can benefit from the convenience and cost-effectiveness of mobile bookkeeping apps to streamline their financial management processes and focus on growing their businesses.

1

1) "Gone are the days of overwhelming paperwork and manual calculations - with mobile bookkeeping apps, financial management just got easier."

2

2) "Small business owners can now breathe a sigh of relief knowing they can manage their finances anytime, anywhere with just a few taps on their mobile device."

3

3) "No more struggling to balance the books at the end of the month - mobile bookkeeping apps make it a breeze to keep track of your finances in real-time."

Conclusion: The Future of Bookkeeping for Small Businesses is Mobile

In conclusion, the future of bookkeeping for small businesses is mobile. As we continue to become more reliant on smartphones and tablets, it only makes sense to simplify financial management for small business owners. Mobile bookkeeping apps offer an easy-to-use, cost-effective, and convenient solution that allows business owners to manage their finances on-the-go. With features like automatic data syncing, receipt tracking, and customizable reporting options, these apps take the hassle out of bookkeeping and allow business owners to focus on what really matters - growing and running their business. Therefore, it's important for small business owners to adapt to this technological shift and embrace mobile bookkeeping apps as their go-to financial management tool.

4) "Simplify your financial management and take control of your business with the convenience and efficiency of mobile bookkeeping apps."

Take Control of Your Finances Anytime, Anywhere with Mobile Bookkeeping Apps for Small Businesses

In conclusion, mobile bookkeeping apps are a great tool for small businesses to take control of their finances anytime and anywhere. These apps allow business owners to keep track of their finances in real-time, which can improve financial management and decision-making. The convenience and flexibility of mobile bookkeeping apps can significantly reduce the time and effort involved in bookkeeping, allowing small business owners to focus on running and growing their business. With affordable and easy-to-use options available, there's no reason for small businesses to continue relying on manual bookkeeping processes. By adopting mobile bookkeeping apps, small business owners can streamline their bookkeeping and financial management and take their business to the next level.