THE BENEFITS OF OUTSOURCED PERSONAL BOOKKEEPING SERVICES FOR SMALL BUSINESS OWNERS

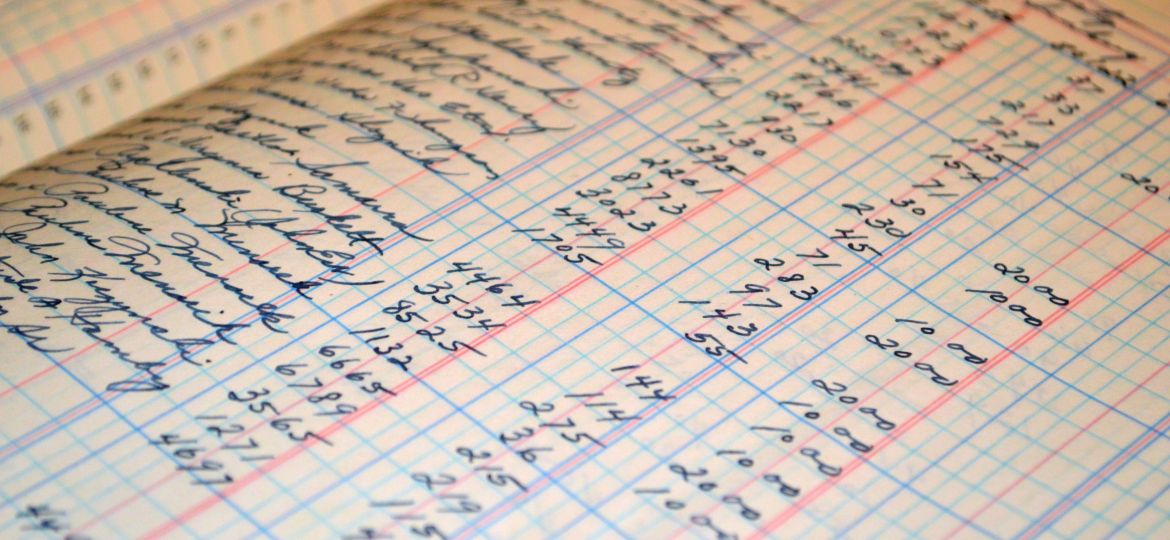

As a small business owner, managing your finances can be a daunting task. Keeping track of your income and expenses, preparing financial statements, and filing taxes on time can be time-consuming and overwhelming. With limited resources and staff, outsourcing your personal bookkeeping services can be an effective solution to ease the burden of managing your finances. In this article, we will explore the benefits of outsourcing personal bookkeeping services and how it can help small business owners like you.

- Time-Saving: A Key Benefit of Outsourced Bookkeeping Services

- Cost-Effective Solutions: Why Small Businesses Should Consider Outsourcing Bookkeeping

- Improved Financial Visibility: How Outsourced Bookkeeping Services can Help Small Business Owners

- Professional Expertise: Benefits of Hiring Outsourced Bookkeepers

- Peace of Mind: How Outsourcing Bookkeeping Services can Help Small Business Owners Focus on What Matters Most

Time-Saving: A Key Benefit of Outsourced Bookkeeping Services

Outsourced bookkeeping services offer a significant time-saving benefit for small business owners. Handing over accounting responsibilities to a professional team frees up time and allows owners to focus on core business activities. With an outsourced bookkeeper, time-consuming tasks such as data entry, bank reconciliations, and financial report preparation are taken off the owner's hands. This not only saves time but also ensures that financial records are accurate, up-to-date, and compliant with regulations. Outsourcing bookkeeping services also eliminates the need to hire an in-house accountant, saving the business money on salaries, benefits, and office space. Overall, outsourcing bookkeeping services gives small business owners more time to concentrate on running their business while ensuring the financial aspects are managed effectively and efficiently.

Cost-Effective Solutions: Why Small Businesses Should Consider Outsourcing Bookkeeping

Cost-effective solutions are one of the main reasons why small business owners should consider outsourcing their bookkeeping services. Hiring an in-house bookkeeper can be costly, as the business would have to provide a salary, benefits, and workspace. Outsourcing bookkeeping services, on the other hand, can be significantly cheaper, as businesses only pay for the services they need. By outsourcing their bookkeeping, businesses can also save on the cost of software and equipment, as the outsourcing firm already has the necessary resources. In addition, outsourcing bookkeeping services can help businesses avoid costly errors and oversights, which could result in financial losses. Therefore, for small businesses looking for cost-effective solutions, outsourcing bookkeeping should be a top consideration.

Improved Financial Visibility: How Outsourced Bookkeeping Services can Help Small Business Owners

One of the major benefits of outsourcing bookkeeping services for small business owners is improved financial visibility. Outsourced bookkeeping services provide accurate and timely financial reports that allow business owners to make informed decisions about their business operations. Business owners can easily access financial records and reports that can help them monitor the performance of the business, identify areas of improvement and make necessary adjustments. Outsourced bookkeeping services provide business owners with better insights into their financial status, thus helping them to plan and manage finances better. With improved financial visibility, small business owners can make informed business decisions that drive growth and profitability.

Professional Expertise: Benefits of Hiring Outsourced Bookkeepers

One of the primary benefits of outsourcing bookkeeping services for small business owners is the access to professional expertise. As small business owners, it is not always possible to have an in-house team of professionals who are well-versed in bookkeeping and accounting principles. Outsourcing bookkeeping services gives small business owners access to experts who have years of experience in the field and can keep track of finances more efficiently. With the support of a professional bookkeeping team, small business owners can rest assured that their financial statements are accurate and up-to-date, and that they are making informed decisions based on sound financial advice. This can ultimately result in better business performance and growth opportunities.

1

Outsourced bookkeeping services offer small business owners the gift of time, allowing them to focus on what truly matters – growing their business.

2

Handing over the financial reins to professionals not only increases accuracy but also provides peace of mind for small business owners.

3

Outsourcing bookkeeping services can save small business owners from costly mistakes and provides access to advanced financial tools and software.

Peace of Mind: How Outsourcing Bookkeeping Services can Help Small Business Owners Focus on What Matters Most

As a small business owner, managing finances can be a daunting task. However, outsourcing bookkeeping services can provide you with the peace of mind you need to focus on what's most important: running your business. By entrusting a team of professionals with your financial records, you can rest assured that everything is being handled accurately and efficiently. This means you can shift your attention to expanding your business, improving customer service, and exploring new opportunities. By outsourcing bookkeeping services, you free up valuable time and resources that you can devote to your core business activities. Ultimately, the peace of mind that comes with outsourcing bookkeeping services allows small business owners to grow and thrive in today's competitive marketplace.

Personal attention and customized services are the hallmark of outsourced bookkeeping, making it an invaluable asset to small business owners seeking to streamline finances.

Maximizing Efficiency and Savings: How Outsourcing Bookkeeping Services Can Help Small Business Owners Focus on Growth.

In conclusion, outsourcing bookkeeping services is an effective strategy for small business owners who want to concentrate on expanding their business and generating more income. The benefits of outsourcing bookkeeping services extend beyond simply saving time and money. By gaining access to experienced and knowledgeable professionals, small business owners can benefit from accurate financial records and reporting, which can help them make informed decisions and focus on achieving long-term growth objectives. Therefore, embracing the concept of outsourcing bookkeeping services can help small business owners operate efficiently, manage their resources effectively, and overcome financial challenges, leading to long-term success and profitability.