HOW OUTSOURCED ACCOUNTING AND BOOKKEEPING SERVICES CAN HELP YOUR BUSINESS GROW

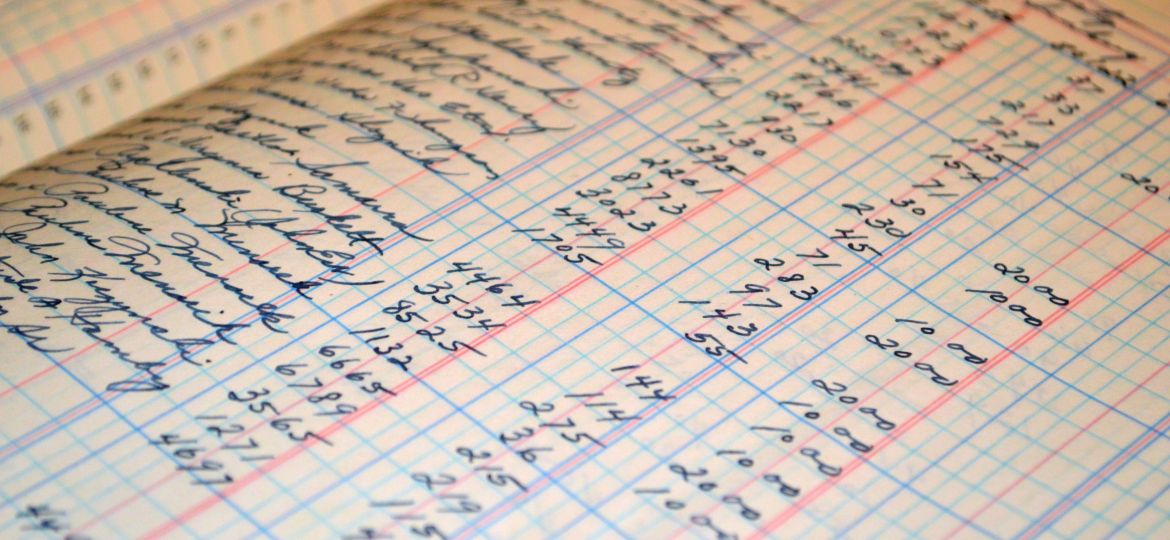

As a business owner, managing your finances comes with its fair share of challenges. From keeping track of cash flows to monitoring expenses, maintaining accurate financial records is crucial for business success. However, the never-ending responsibilities of managing the books can be overwhelming, often diverting your attention away from your core business operations. That's where outsourced accounting and bookkeeping services come in to help. Not only do these services take care of your financial records, but they also offer numerous benefits that can help your business grow. In this article, we'll explore how outsourcing your accounting and bookkeeping services can help your business reach new heights.

- Streamlining Accounting Process: How Outsourcing Can Save Time and Money

- Professional Accounting Expertise: Why Outsourcing Can Improve the Quality of Your Financial Reports

- Freeing up Resources: How Outsourcing Can Help Small Businesses Focus on Growth

- Scalability: Can Outsourcing Support Sustainable Business Growth?

- Mitigating Risks: Ensuring Compliance and Reducing Financial Errors through Outsourcing

Streamlining Accounting Process: How Outsourcing Can Save Time and Money

Outsourcing accounting and bookkeeping services can streamline the financial processes of your business, leading to significant cost and time savings. With outsourcing, your organization can delegate complex accounting tasks such as payroll, tax preparation, and month-end closing to experienced professionals with a deep understanding of accounting principles. This allows your in-house team to allocate their time and effort towards other essential business activities, increasing productivity and efficiency. Additionally, outsourced accounting firms use the latest technology and software, thereby reducing operational costs and allowing businesses to save money on infrastructure and maintenance. Ultimately, outsourcing accounting and bookkeeping services can transform your business’s ability to function effectively, providing you with the tangible benefits necessary to scale up and grow your business.

Professional Accounting Expertise: Why Outsourcing Can Improve the Quality of Your Financial Reports

Professional Accounting Expertise plays a crucial role in ensuring the accuracy and quality of financial reports. Outsourcing accounting and bookkeeping services to a team of professional accountants brings extensive knowledge and expertise to your business. These experts are equipped with the necessary qualifications and experience to handle all financial aspects of your business, from basic entries to complex financial analyses. Outsourcing accounting services ensures that you have accurate and up-to-date financial data, which is essential for making informed decisions. Furthermore, professional accountants are knowledgeable about tax regulations and other financial compliance requirements, which reduces the risk of financial errors. Outsourcing accounting services can give your business a competitive edge by providing better financial insights that can help you drive business growth.

Freeing up Resources: How Outsourcing Can Help Small Businesses Focus on Growth

Outsourcing accounting and bookkeeping services can help small businesses by freeing up resources that can be used for more important functions of the company. Instead of spending hours on end tracking expenses, creating financial reports, and chasing after unpaid invoices, businesses can outsource these tasks to a qualified team of professionals. This leaves entrepreneurs with more time to focus on growing their business and expanding their customer base. Outsourcing also reduces the need for hiring in-house accounting staff, which can save on overhead costs, training, and benefits. Overall, outsourcing accounting and bookkeeping services is a smart move for small businesses looking to increase productivity and profitability.

Scalability: Can Outsourcing Support Sustainable Business Growth?

Scalability is a crucial factor in sustaining business growth. Outsourcing accounting and bookkeeping services can help your business scale effortlessly by providing you with the right tools and resources to meet your business goals. Outsourcing helps drive operational efficiency by freeing in-house staff from manual bookkeeping tasks to focus on strategic business initiatives. This can enable companies to respond quickly to changes in the market and invest in the growth of their businesses. With outsourced accounting and bookkeeping services, businesses can find it easier to manage increased transaction volumes and complex financial data, enabling them to scale successfully. Overall, outsourcing can be an invaluable tool to help businesses sustain growth and achieve long-term success.

1

Outsourcing your accounting and bookkeeping tasks allows you to focus on what you do best - growing your business.

2

Maximize your business potential with the expertise of outsourced accounting and bookkeeping services.

3

Hiring an outsourced team of financial professionals frees up valuable time and resources for your business.

Mitigating Risks: Ensuring Compliance and Reducing Financial Errors through Outsourcing

Outsourcing accounting and bookkeeping services can help your business mitigate risks and ensure compliance with regulations. Professional accountants and bookkeepers are knowledgeable about industry standards and can keep your financial records accurate to prevent any run-ins with government agencies. Additionally, they can also provide you with insights and recommendations to reduce financial errors, which can further create an efficient and healthy financial ecosystem for your business. Thus, outsourcing can provide a secure, streamlined, and compliant financial management solution for your business, allowing you to focus on growing your business and achieving your goals.

Let the pros handle the numbers while you focus on taking your business to new heights.

Boost Your Business Growth with Outsourced Accounting and Bookkeeping Services

In summary, outsourcing your accounting and bookkeeping needs can tremendously boost your business growth. By entrusting these essential tasks to a team of experienced professionals, you can focus on other crucial aspects of your business, such as expanding your customer base, improving customer experiences, and developing new products. Additionally, outsourcing helps to reduce overhead costs, provides access to advanced technologies and industry expertise, and ensures compliance with local tax laws. Therefore, if you're looking to scale your business, increase profitability, and stay ahead of the competition, consider partnering with a reliable outsourcing firm for your accounting and bookkeeping needs.